Ready to dive into the financial pool but worried about getting in over your head? Don't worry, investing isn't just for the sharks and whales of Wall Street. Think of it as getting your feet wet in a pool of opportunities where, with a little splash of knowledge, you can swim with the best of them. So, let's dip our toes into the diverse world of investing activities, where the only thing deep is the potential for your money to grow—not the jargon.

What Are Investing Activities?

In simple terms, investing activities involve putting your money into things that you believe will be worth more in the future. It's like planting a money tree and hoping it'll grow big and strong, bearing fruits of profit. These activities aren't just buying and selling; they're strategic moves to help your money grow over time and include buying stocks, bonds, real estate, and more.

Types of Investing Activities for the Everyday Investor

Stock Market

Imagine owning a tiny piece of a big company like Apple or McDonald's. That's what buying stocks is—becoming part-owner in businesses you believe in. There's a variety to choose from, ranging from single stocks to baskets of them in mutual funds or ETFs (which are like mixed investment salads).

Bonds

Think of bonds as lending money to your friend, but in this case, your friend is a company or the government. They promise to pay you back with a little extra as a thank you. It's a steadier, less roller-coaster-y option.

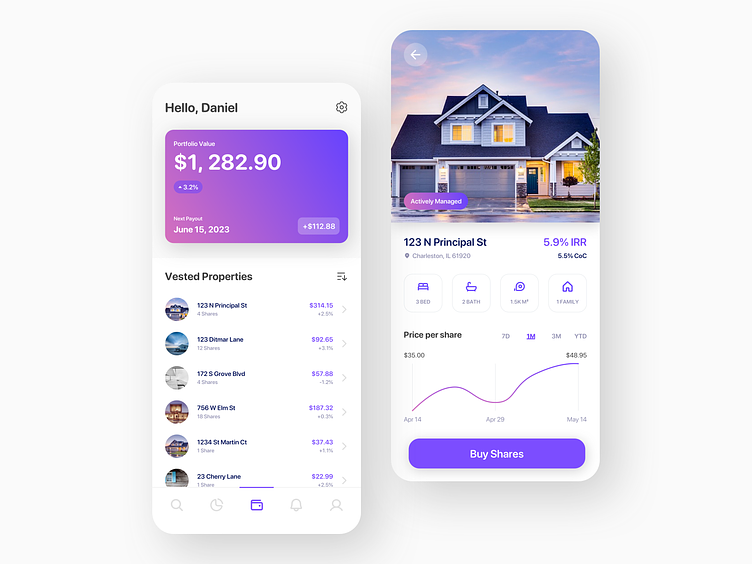

Real Estate

Buying property to either rent out or sell for more later. It's like the board game Monopoly, but in real life and with real money. More hands-on, but potentially very rewarding.

Commodity Trading

This is investing in physical stuff like gold, oil, or wheat. It's betting on the price of these items going up or down. A bit like guessing whether tomorrow will be sunny or rainy for crops.

Alternative Investments

The treasure chest of unusual options—things like art, wine, or even cryptocurrencies. Not the usual path, but who knows? You might find a hidden gem.

Simple Strategies for Diving In

Spread Your Towels (Diversification)

Just like you wouldn’t lay all your towels down in one corner of the beach, don’t put all your money into one type of investment. Spreading your investments across stocks, bonds, real estate, and more can help protect you from losing all your money if one investment doesn't perform well. It’s like making friends in different social circles; if one group is having a bad day, you can hang out with another. Diversification helps smooth out the bumps on your investment journey, making it a less nerve-wracking experience.

Do Your Poolside Reading (Research)

Before you jump into a pool, you probably want to know how deep it is, if the water's warm, and whether it's crowded. Applying the same principle, before investing your money, take some time to learn about the investment. Look into the company’s or property’s background, financial health, and the market's current conditions. This research can help you make more informed decisions, much like reading a review before buying a product online. It doesn’t guarantee success, but it certainly lowers the risk of a belly flop.

Plan Your Swim (Long-Term Thinking)

Investing isn’t a sprint; it’s more like a marathon. Short-term market fluctuations can be like waves—they might look scary close up but are less significant from further back. By focusing on your long-term financial goals, you can avoid making hasty decisions based on temporary setbacks or trends. It’s like planning a route through the ocean; knowing your destination helps you navigate and stay the course, even when currents try to push you off track.

Watch the Lifeguards (Risk Management)

Just as lifeguards keep an eye on swimmers to prevent accidents, risk management involves setting up safety nets for your investments. This could mean setting aside a portion of your portfolio in safer investments, like bonds, or setting limits on how much you’re willing to lose in a particular investment before you pull out. It’s about knowing your comfort level with risk and making sure you don’t end up in deeper water than you can handle. By being cautious and prepared, you can enjoy the investment pool while minimizing the chance of getting caught in a riptide.

Diving into investing doesn't have to be a leap into the unknown. With a bit of knowledge and strategy, you can navigate the waters of investing activities without feeling like you're swimming against the tide. Remember, the goal isn't to make a splash with risky jumps but to enjoy a steady swim towards financial growth. So, take the plunge—the water's fine, and the potential rewards are waiting on the other side of the pool.

Investing is an adventure, an opportunity to explore uncharted financial waters with curiosity and courage. Whether you're just dipping your toes or ready to dive in headfirst, the world of investing is vast and full of potential treasures. So, why not dive into the deep end? After all, you never know what pearls of opportunity you might find beneath the surface.