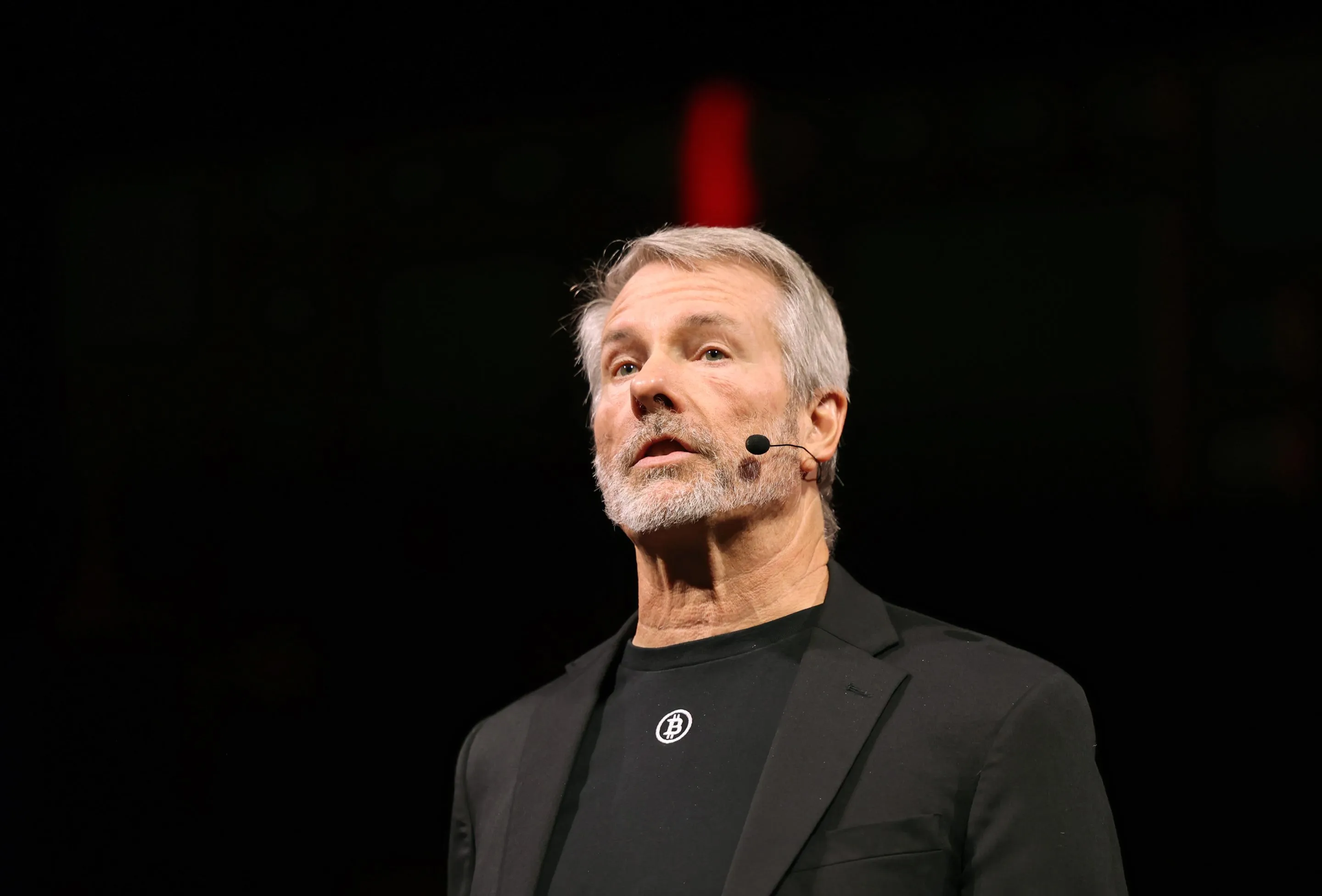

The once high-flying stock of Strategy, formerly known as MicroStrategy, is now trading at two-thirds below its peak, a far steeper decline than Bitcoin itself. This dramatic slide comes as the company, which transformed itself into the world's largest corporate Bitcoin holder, faces $21 billion in debt obligations and growing skepticism about its leveraged crypto strategy. With $844 million due to lenders within the next year and convertible debt holders expecting shares worth $672 while they trade around $171, the pressure on executive chairman Michael Saylor and CEO Phong Le has never been greater.

From Software to Bitcoin: The $60 Billion Pivot

In February 2025, MicroStrategy officially rebranded as Strategy, unveiling a new Bitcoin-inspired logo and orange brand color that signaled its complete transformation from a business intelligence software company to a "Bitcoin treasury company." The move came alongside a fourth consecutive quarterly loss, with the company booking a $1.01 billion impairment charge on its digital asset holdings. At that time, Strategy held 471,107 bitcoins with a market value of $46 billion, having purchased 218,887 coins for $20.5 billion in the fourth quarter alone—its largest quarterly increase ever.

The company's aggressive Bitcoin acquisition strategy began in 2020 when Saylor, convinced that Federal Reserve policies would debase the U.S. dollar, personally invested $100 million in Bitcoin before committing corporate funds. What followed was a financial engineering marvel: Strategy regularly issued new shares and borrowed money at near-zero interest rates through convertible bonds, using all proceeds to buy more Bitcoin. This created what some analysts call an "infinite money glitch"—until Bitcoin's price stopped rising.

The Timeline: How Strategy's Bitcoin Bet Unfolded

Strategy's journey from software vendor to Bitcoin behemoth follows a clear, escalating timeline. In June 2020, Michael Saylor made his personal $100 million Bitcoin purchase. By August 2020, MicroStrategy announced it would spend the vast majority of its corporate cash to acquire Bitcoin. The company's Bitcoin holdings grew from $1.9 billion in March 2021 to $2.9 billion a year later, then exploded to $23.9 billion by the end of 2024.

December 2024 brought inclusion in the Nasdaq-100 index, a milestone reflecting the stock's 547% gain that year. February 2025 marked the official rebranding to Strategy. By July 2025, the stock peaked at $474 per share as crypto rallied, with Saylor's paper wealth exceeding $10 billion. Then the decline began: a 24% Bitcoin spiral in October 2025 triggered by President Trump's trade policies, followed by Strategy's stock losing 63-66% of its value by January 2026.

Why Strategy Matters: The Leveraged Bitcoin Experiment

Strategy represents more than just one company's bet on cryptocurrency—it's a test case for whether corporations can successfully use leverage to amplify Bitcoin exposure. "We're designed to outperform Bitcoin in the long term. We're leveraged Bitcoin," CEO Phong Le told DL News in December 2025. This leverage works spectacularly when Bitcoin rises but creates catastrophic pressure when prices fall.

The company's financial structure has drawn criticism from across the investment community. Veteran financial analyst Herb Greenberg calls Strategy a "quasi Ponzi scheme" in which current investors can be paid back only with money from new investors. Short-seller Marc Cohodes dismisses Saylor as a "preacher and a Jim Jones-type." Even crypto-friendly investor Jan van Eck of VanEck said, "We've stayed away. It's just publicity."

Standard & Poor's reassigned Strategy a junk rating in December 2025, noting that in the first half of 2025, the company's $8.1 billion in earnings was entirely composed of paper appreciation of its Bitcoin, rather than traditional corporate earnings. The fundamental concern: Strategy's market worth, which peaked above $120 billion, has regularly been higher than the sum of its Bitcoin holdings, suggesting that even if it liquidated everything, it would be short of paying back shareholders, let alone its debt.

Where Things Stand Now: Debt, Dividends, and Doubt

As of January 2026, Strategy owes $21 billion to its lenders and preferred shareholders, with $844 million due within the next year. More concerning: convertible debt holders who lent money at zero percent interest expect to swap into stock that Strategy promised would be worth $672 per share. With the stock trading around $171, Strategy will have to find money to bridge the difference. In the next three years, $5 billion of such loans are due.

The company's preferred share offerings—with names like "Strike," "Strife," and "Stretch"—promise 8-11% cash dividends, creating another obligation. As Saylor told a podcast last fall, "It's not quite a high-yield bank account, but you would be pretty close." Yet buying Bitcoin and waiting for it to go up doesn't generate cash for dividends. The money can only be easily produced when Bitcoin is rising.

Perhaps most tellingly, Saylor has begun backing off his die-before-selling Bitcoin rhetoric. Strategy announced in December 2025 that it had issued more stock to build a $2 billion cash cushion. CEO Phong Le said on a crypto podcast that "we would sell Bitcoin if we needed to," a move Saylor separately described as "rational."

What Happens Next: The 2026 Bitcoin Prediction

Despite the challenges, Strategy's leadership remains bullish about 2026. CEO Phong Le predicts the year will "unleash a wave of Bitcoin buying" driven by nation-state adoption. "I think we're going to see more risk-on buying as we enter the mid-term election period," Le told Fox Business. "I think bank adoption, nation state adoption, is going to increase."

This optimism comes as Strategy holds 671,268 Bitcoin at an average price of $74,972 per coin, according to December 2025 SEC filings. With Bitcoin trading around $89,600 in early 2026, the company's position shows an unrealized gain of less than 15%—a thin margin that worries critics like gold bug Peter Schiff, who blasted Saylor on X: "MSTR would've been better off had Saylor purchased any other asset class."

The company has created a $1.4 billion cash reserve to shield itself from market swings, designed to cover at least 21 months of dividend and interest payments. "Folks need to remember," Le said. "If Bitcoin goes up 1.4% per year, we'll be able to pay our dividends into eternity."

The Bottom Line: Key Points to Remember

- Strategy holds over 671,268 Bitcoin worth approximately $60 billion, making it the world's largest corporate holder.

- The stock has fallen 66% since July 2025, underperforming Bitcoin during the same period.

- The company faces $21 billion in debt obligations, with $844 million due within a year.

- Strategy has built a $1.4-2 billion cash cushion to weather potential Bitcoin price declines.

- CEO Phong Le predicts massive nation-state Bitcoin buying in 2026, while critics warn of a potential collapse if Bitcoin prices fall below the company's average acquisition cost of $74,972.

- Michael Saylor's long-term Bitcoin price prediction remains $13 million by 2045, but his company's immediate survival may depend on Bitcoin staying above $74,000.

As the crypto community watches nervously, the biggest question remains: If Strategy, the market's biggest whale, begins selling Bitcoin to meet obligations, could it trigger a broader market downturn that would reverberate through mainstream financial firms like Fidelity, Barclays, and Cantor Fitzgerald? The answer may determine not just Strategy's fate, but the stability of the entire corporate Bitcoin adoption movement.