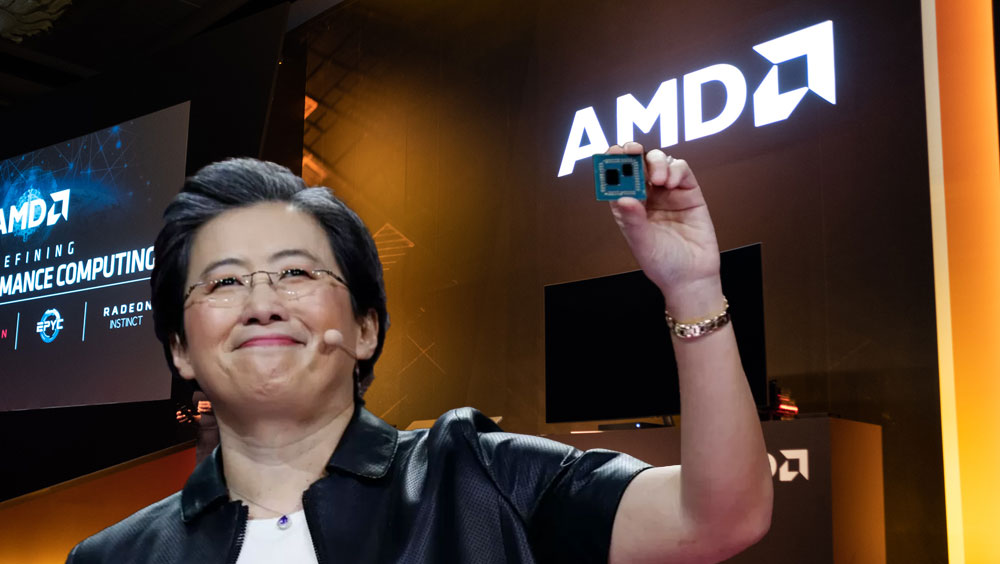

Lisa Su, President, and CEO of Advanced Micro Devices topped the list of the highest-paid female executives for 2020. Her $27.1 million compensation package includes her base salary of over $1 million, her added cash bonuses worth nearly $2.5 million, and additional stock options totaling $23.5 million.

While this salary is quite impressive, it’s significantly lower than her 2019 total compensation package of $58.53 million. Why such a big difference in pay? In 2019, Su was rewarded for a strong performing year with over 775,000 restricted share units worth more than $42 million. This bonus was also to serve as an incentive over than next five years. Given her latest earnings, Su’s overall net worth is valued at $419 (as of December 7, 2021). This includes 125,000 units of Advanced Micro Devices with a value of over $287 million.

There’s no denying that under Su’s supervision, Advanced Micro Devices saw substantial growth. For example, company stock was trading at just $4 per share when Su took the reins in 2014. Today, trading started at over $120 per share. Investors who were fortunate enough to take a risk on Su’s performance have been pleasantly rewarded with a 1,700% increase.

This increase in shares is primarily due to the company’s ability to grow its net income year-over-year. While the company remained in the red for much of 2014-2017, Advanced Micro Devices, under Su’s direction, realized a 630% growth in net income from 2019 ($341 million) to 2020 ($2.49 billion). The company also reported strong results for the first three quarters of 2021.

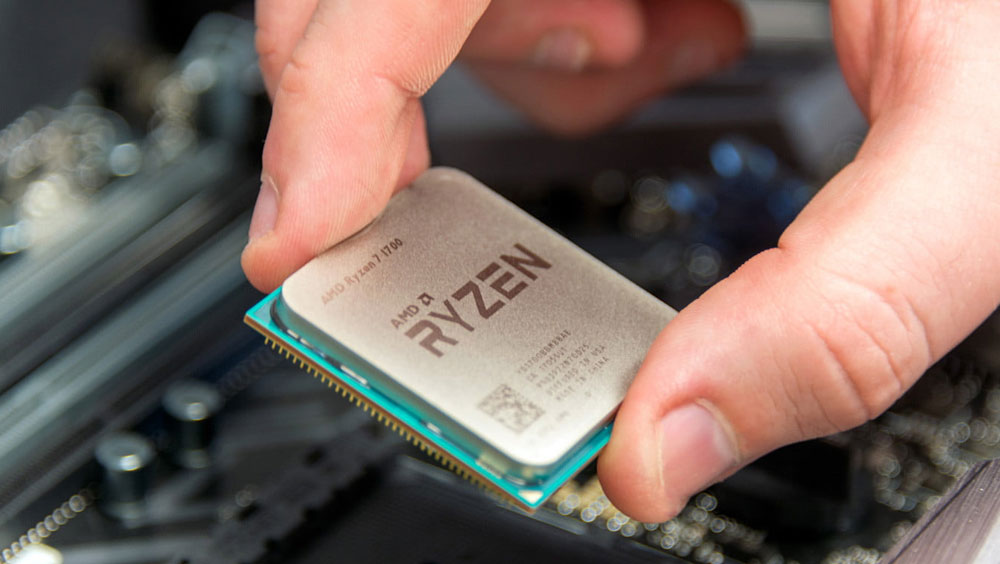

To strengthen the company even further, this increase is not due to substantial costs cuts. Instead, Su made some difficult decisions, such as finding a reliable chip manufacturer and scrapping several development projects to focus on the company’s prime offering, small chips, which are easier to produce.

These risks have paid off for Advanced Micro Devices and its investors. So much so that the company is slowly moving into Intel’s space and finding firm standing. For example, just a few years ago Intel had control over about 80% of the market for chips in servers and PCs. Today, Advanced Micro Devices is hoping to take over at least 50% of this market.

Investors interested in adding to their portfolio may want to take a closer look at Advanced Micro Devices.