Good investors know you have to diversify your portfolio. Otherwise, you're at the mercy of the ups and downs of whatever investment you're hip-deep into. The problem is, when all the other investors are trying to diversify at the same time you are, it can be hard to find novel territory where you can get a decent return. This has led to the rise of alternative investments, which are a bit too offbeat for most index funds.

What Counts as an Alternative Investment?

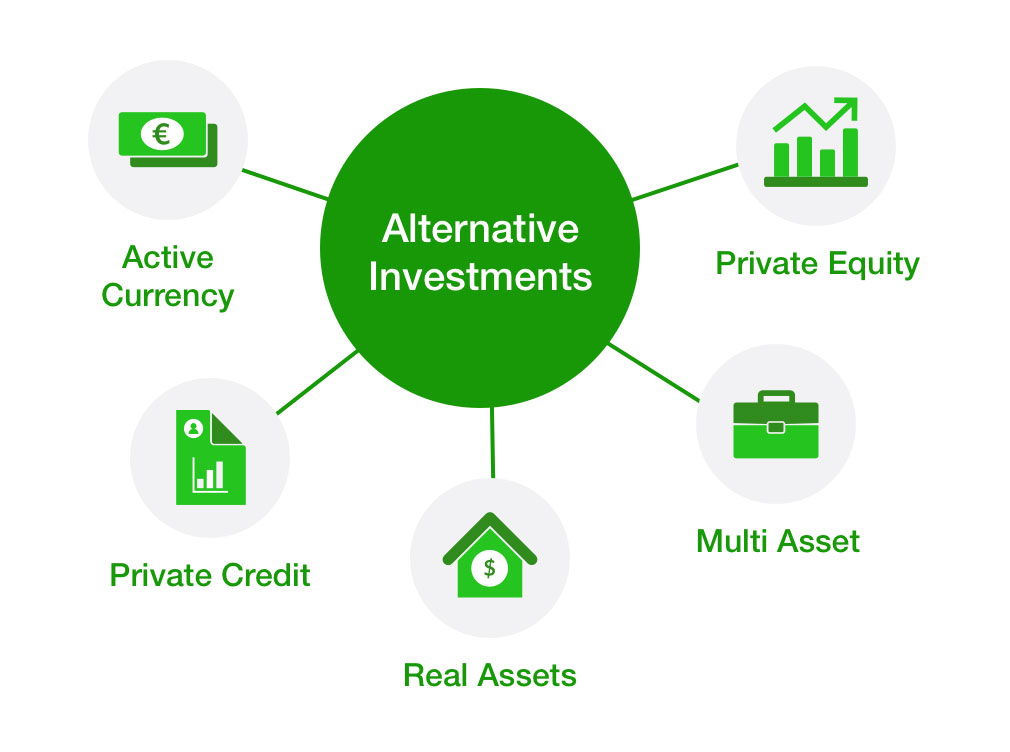

Alternative investment isn't a well-defined category, but some types of investment count more than others. Traditional investments include stocks and bonds, plus some commodities and maybe derivatives. To be alternative, an investment should be a bit more off the beaten path. Real estate can be a fairly conservative alternative to traditional investing strategies. Other instruments are more uncertain. Art, EFTs, crypto, emerging market currencies, and African municipal development bonds are all good examples of alternative investments that have been popular since about 2010 or so.

The Place for Alternative Investments in Your Portfolio

As that list of investment choices suggests, alternative options run the gamut from relatively safe bets to wild speculation. As a rule, it's best to use alternative investments as a supplement to your traditional portfolio, rather than as a strategy on their own. The standard model is to use alternatives as a supplement to pick up some higher returns on the side, albeit with a significantly elevated risk over traditional investments. Always consult with a licensed financial advisor before making an investment decision, and choose your alternative investment strategy carefully to manage your risk.