What is the Boring Company?

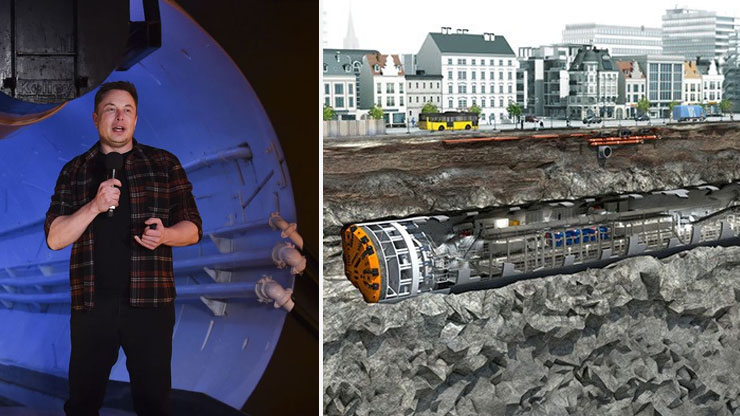

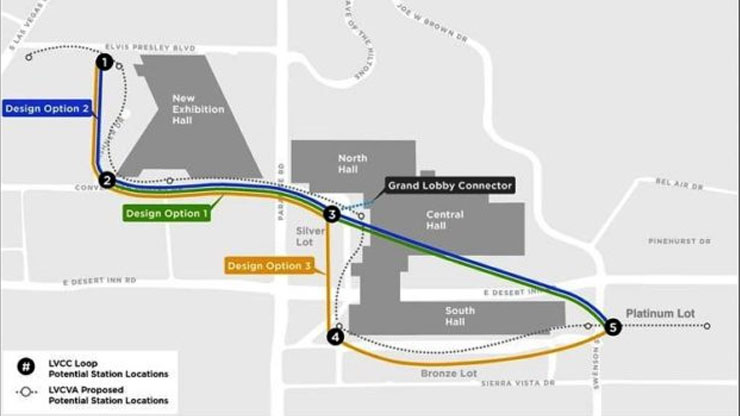

The Boring Company is a new transportation company created and founded by none other than Elon Musk. Its goal is to create an sustain a vast and sophisticated infrastructure that uses interconnected loops and tunnels within the greater Los Angeles area. This allows for improved commuting for drivers and those who rely on public transportation on a daily basis.

Boring Company Stock: Is It Worthy of Investment?

Because the Boring Company was founded back in late 2016, it is still very new. And as with any new venture, it requires a special scrutiny before making any kind of investment. As it stands, there is no initial public offering for potential investors, but that doesn't mean anything. There are still options to consider investing whether or not an IPO is available at this point.

With the company taking off and going strong, investors are still interested in buying shares. There are steps involved which can serve as a blueprint for corporate stock of any kind. The key is choosing wisely after a period of careful research and much thought.

Steps to Investing: A Sensible Blueprint

You should begin your portfolio by opening an online brokerage account. You can do so by simply going online, filling out an application, and making your deposit. From there, you can either hire a professional stockbroker or decide to buy shares straight from the company's website. After this step, you need to start doing a lot of research. Anything from BBB ratings to Google reviews should offer you an excellent glimpse into the company's reputation and stamina when it comes to customer service and it's products.

Phase three involves deciding the amount of shares you'd like to purchase. Much of your decision depends on financial risk assessment and how much you'd like to make in profits. If you happen to be a rookie investor, you should definitely consider buying only a single share just to be safe. You can sell anytime you need to, or you can keep monitoring the ebb and flow of your investment. Either way, caution is advised early on in the game. You can even opt to purchase a half share if you want to be even more succinct with your money.

The final phase lies in determining which type of stock order you want. An ask is simply the amount that the seller is willing to accept from you, while the bid is what you, the buyer, are proposing to pay. The spread is a spectrum of pricing that goes from the highest bid to the lowest ask amount, while the market order offers the lowest price right away. A limit order can be a fixed price or lower, while the stop-loss order simply puts the shares at a market order price once they reach a peak amount. A stop-limit order follows where the limit order is enacted until required price limits can be met.

Once you get familiar with the ins and outs of investing, your next step is building your stock portfolio. This should be your grande finale towards financial growth and sustainability.