Many people want the opportunity to invest in popular companies that have proven themselves to be successful over time. Subway is one of those companies that continues to maintain a loyal customer base making it popular among interested investors. Unfortunately for these investors, Subway is a privately-held company and does not have public stocks for purchase. Investors cannot access Subway stocks on the New York stock exchange or any other because Subway uses a franchise system where each location is owned and operated by separate individuals. Subway makes its money by selling these franchises to individuals and collecting the agreed-upon royalties from each.

What is a Privately-Held Company?

Privately-held companies such as Subway choose not to make stock publicly available because private ownership allows them more control over their operations and income. By selling franchises, they have created an across-the-board system that the owners follow upon purchase. These owners then pay a percentage of royalties back to the Subway company. The United States federal law requires that any company that is publicly traded make their financial data and other information public knowledge. These financial reports are posted on the U.S. Securities and Exchange Commission website and give potential investors an inside look at how much money the company makes. Subway is not required to do this as a privately-held company meaning that they can keep information private from potential franchise owners and competitors. Publicly traded companies are also required to elect a board of directors which takes some of the power out of the company's hands and leaves it open to the whims of public opinion.

How Can I Invest in Subway?

The only way to become a Subway investor is to purchase and open a franchise. Buyers are required to pay $15,000 for the franchise purchase and then must invest a minimum of $102,000 to purchase the store and set it up to company standards. The business is run under individual ownership and management, but it must follow corporate guidelines and, according to Franchise, pay Subway 12.5% of weekly revenue. Like many other franchise companies, Subway prefers to maintain control of their business and avoid the public trade sector. This has not in any way limited their ability to be successful. Subway has more than 21,000 franchises across the globe allowing aspiring small business owners to reach success without the trial and error of a from-the-ground startup. They even waive the franchise fee for honorably discharged veterans who open their restaurant on government or military property.

Alternative Stock Options to Subway

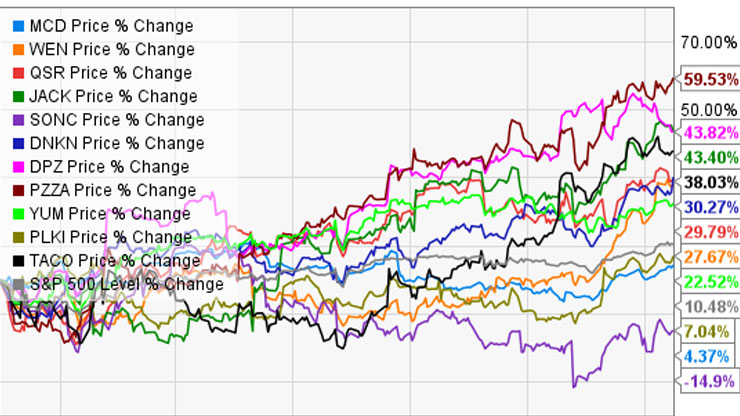

While Subway isn't an option in the stock market, there are other fast-food chains that are publicly traded. One strong option is Restaurant Brands International. They are in charge of Burger King, Tim Horton's, and Popeye's. These companies have franchises all over the world and are highly competitive fast-food brands. Even throughout 2020 in the wake of the coronavirus pandemic, Restaurant Brands showed a significant profit.

Another viable investment option in place of Subway is the ever-popular Starbucks Corporation. They are an extremely successful franchise and showed significant revenue growth in 2020. Its stock is at a reasonable price, and because the financial information is public, it is easy to decide whether it is a good investment for you.

Investing in Fast Food

People tend to like the idea of investing in fast food because it is a service that appears to be around to stay. No matter the state of the market, people will always need to eat. The great thing about investing in publicly traded companies is that investors can see the financial numbers and trends before they get involved. A $15,000 investment in a publicly-traded stock can be less risky and less work than a $15,000 franchise purchase. Private franchises leave investors with worries about revenue instability and sustainability. Public fast food stock allows for full disclosure.