White Claw would be a great investment opportunity...if it were available on any stock market. The bad news for investors is that White Claw's owner, Mark Anthony Brands, has no intention of going public. That means White Claw will remain a privately held product in a privately held company. Potential investors will have to settle for other opportunities in the red-hot hard seltzer category.

ABOUT HARD SELTZER

Hard seltzer is the most disruptive product to hit the alcohol business in years, maybe since Prohibition. Hard seltzers have been around seemingly forever but, in 2016, the demand for a healthier, lower-calorie beverage, started to drive demand. Experts in the alcohol industry credit the millennial generation with lighting the fuse on hard seltzer. In 2016, hard seltzer as a product category had sales of $41 million. In three years, to 2019, that jumped to $1 billion. 2020 saw an increase to $1.8 billion and 2021 is projected to reach $2.5 billion. That comes out to an average annual revenue increase of 128%.

THE STORY OF AND INTERNATIONAL INTRIGUE AROUND WHITE CLAW

White Claw was introduced in 2016 when its owner, Mark Anthony Brands, saw the resurgence of the hard seltzer category. Mark Anthony Brands was founded in 1972 as a one-man wine importing business. Today, it is the largest ready-to-drink company in North America. In addition to White Claw, it produces Mike's Hard Lemonade.

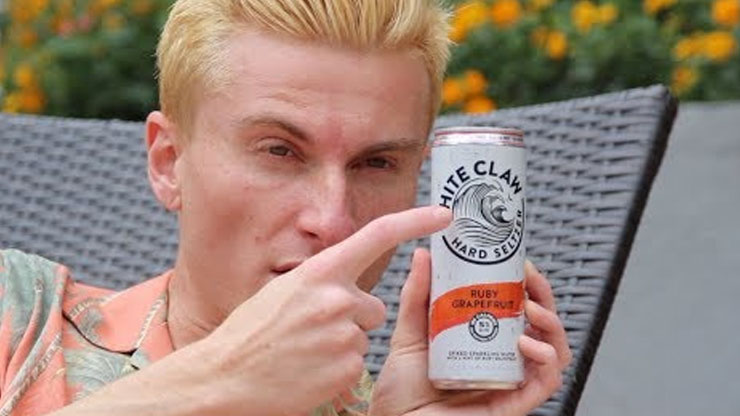

White Claw is made with seltzer water, fruit flavor, and a gluten-free malted alcohol base (which was called a beer base by US Customs). White Claw was originally classified as a beer by the US Customs Service. That meant there was no tariff on exported products. In 2021, US Customs reclassified White Claw into the "other beverages" category, which put a tariff on the product.

White Claw owns the hard seltzer product category. White Claw accounts for nearly 60% of sales in the category and the Mark Anthony Group has said it generated $4 billion in revenue in 2020. The biggest problem White Claw has faced is product shortages in 2019. Demand for the product increased at a rate such that supply couldn't keep up. The Mark Anthony Group has a manufacturing plant in Glendale, Arizona, and is planning on opening a second plant in South Carolina in 2021.

IF I CAN'T BUY WHITE CLAW STOCK, WHAT ABOUT OTHER HARD SELTZERS?

It would be nice to tell you something's afoot with White Claw stock. But that's not happening anytime soon.

You can invest in the hard seltzer category through the parent companies of several White Claw competitors. Truly Hard Seltzer is number two in the category, with approximately 27% of sales. Truly is owned by Boston Beer (NYSE: SAM), brewers of Samuel Adams beer. That stock is available on the NYSE. Industry experts believe that White Claw and Truly will eventually divide 60 - 70% of the hard seltzer market.

There are two others also available on the New York Stock Exchange. AB Inbev (BUD) is marketing Bud Light Seltzer while Constellation (STZ) has put Corona Hard Seltzer on the market.