What is investing? In simple terms, investing is the process of putting your money to work to generate a profit over time. It's a powerful financial strategy used by individuals, businesses, and governments to build wealth and secure future financial stability. Whether you're saving for retirement, a child's education, or simply looking to grow your money over the long term, understanding investing is the first step toward financial empowerment. This article explores the basics of investing, types of investments, and why it's crucial for your financial future.

Understanding The Basics: What Is Investing?

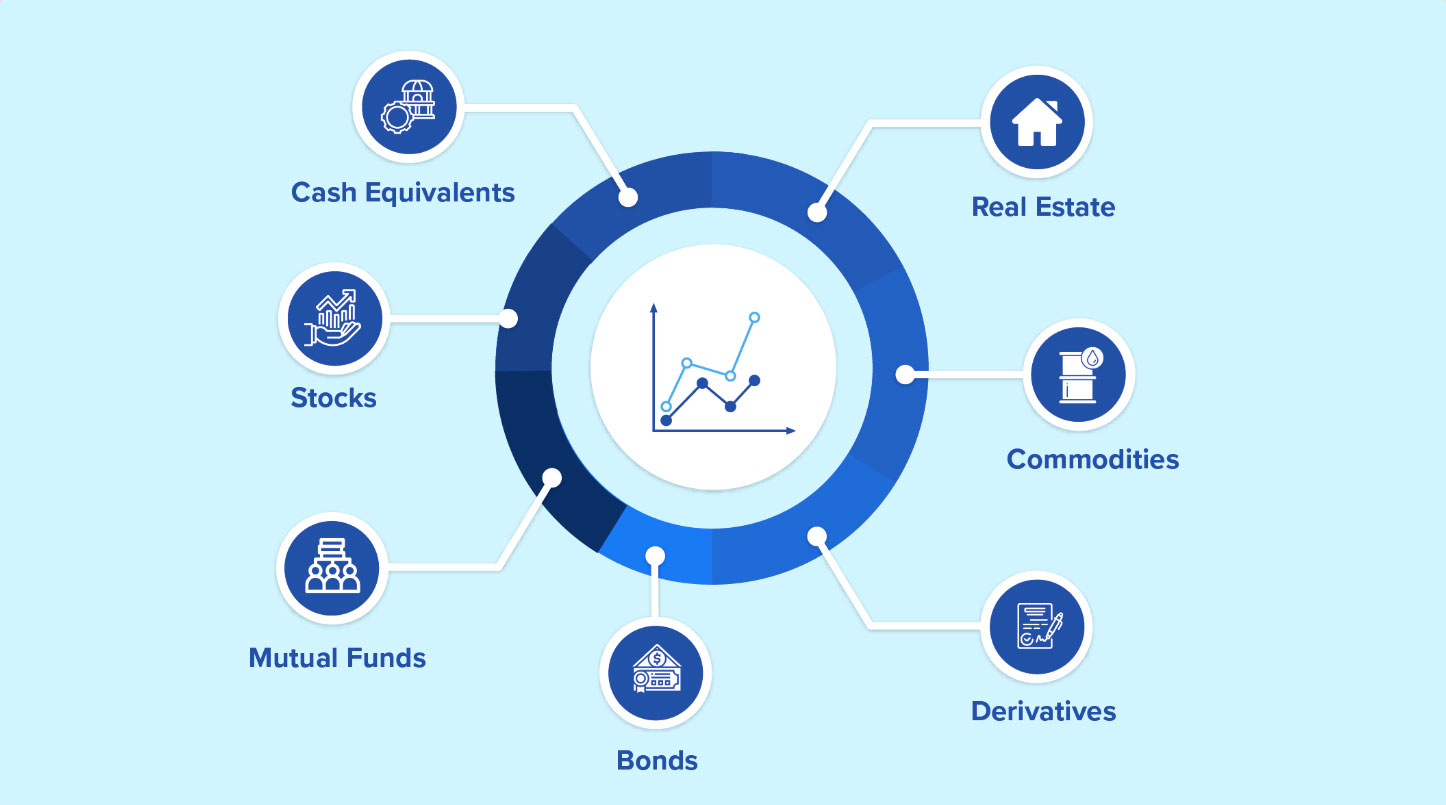

What is investing? At its core, investing involves allocating money into assets—such as stocks, bonds, real estate, or mutual funds—with the expectation of earning a return. Unlike saving, which typically involves low-risk, low-return options like a savings account, investing embraces a certain level of risk in exchange for potentially higher rewards. By understanding the fundamentals of investing, individuals can make informed decisions to increase their financial potential.

Why Is Investing Important?

Investing is essential for achieving long-term financial goals. Whether you're aiming to retire comfortably, buy a house, or fund education, investing helps your money grow faster than traditional saving methods. The power of compound interest—the concept of earning interest on interest—allows your investments to increase in value over time. Understanding what is investing and why it matters sets the foundation for building lasting wealth.

Types Of Investments

There are several types of investment vehicles available, each with its own risk and return profile. Common investment options include stocks, bonds, real estate, mutual funds, ETFs, and commodities. Knowing what is investing means understanding the characteristics of each investment option and how they align with your financial goals. Diversifying your investments can help reduce risk and improve long-term growth potential.

Stocks And Equities

Investing in stocks means purchasing a share of ownership in a company. Stocks are considered one of the riskiest forms of investment, but they also offer the highest potential returns. When you invest in stocks, your returns come from share price appreciation and dividends. Understanding what is investing includes recognizing the potential of equities to grow your wealth over time.

Bonds And Fixed-Income Securities

Bonds are loans made by investors to entities like governments or corporations. In return, the borrower pays regular interest and returns the principal at maturity. Bonds are generally lower risk than stocks but also offer lower returns. As you explore what is investing, it's crucial to know how bonds can add stability to your investment portfolio.

Real Estate Investment

Real estate investing involves buying, owning, managing, or selling properties for profit. It can provide rental income as well as capital appreciation over time. From residential homes to commercial buildings, real estate offers tangible assets and potential tax benefits. Learning what is investing includes understanding how real estate can diversify and strengthen your investment strategy.

Mutual Funds And ETFs

Mutual funds and Exchange-Traded Funds (ETFs) pool money from many investors to buy a diversified portfolio of assets. These funds are managed by professionals and are an excellent choice for beginner investors. They offer diversification and ease of entry with relatively low initial investments. Discovering what is investing often includes learning about these accessible and balanced investment tools.

Risk Management And Investment Strategy

Investing always involves risk, including market volatility, economic downturns, and loss of principal. A sound investment strategy balances risk with potential return through diversification and long-term planning. Understanding what is investing also means recognizing your personal risk tolerance and aligning your investments with your financial goals.

The Role Of Time in Investing

Time is one of the most critical factors in successful investing. The earlier you begin investing, the more time you have for your investments to grow and recover from market fluctuations. Long-term investing allows the benefits of compound growth to take full effect. When considering what is investing, understanding the impact of time can greatly influence your decisions and outcomes.

In conclusion, understanding what is investing is a vital step toward achieving financial success. Investing enables you to grow your wealth, outpace inflation, and prepare for the future. Whether you're interested in stocks, bonds, real estate, or funds, making informed investment decisions can help you reach your personal financial goals. Start early, diversify wisely, and stay focused on the long-term to make the most of your investment journey.