You see and hear mobile phone companies touting their 5G service as the latest and greatest improvement for your cell phone. That's true. You'll enjoy more bandwidth and faster download speeds with 5G. What's also true is that 5G has such increased capabilities, companies providing the service can now compete as an Internet Service Provider (ISP) to your home or business. This additional reach is what has analysts and investors looking hard at companies such as these:

SKYWORKS SOLUTIONS INC (NASDAQ: SWKS)

Skyworks supplies chips to the leading 5G smartphone manufacturers. That's Apple and Samsung. Skyworks gets 67% of its business from these smartphone companies. Because of this reliance on the 5G smartphone market, Skyworks suffered from lower revenue and profits during the pandemic. However, that downtrend has reversed itself as the smartphone market returns to normal. The company is hedging against this 5G reliance by expanding its business in the Internet of Things, including smart homes and networking devices.

QUALCOMM INC (NASDAQ: QCOM)

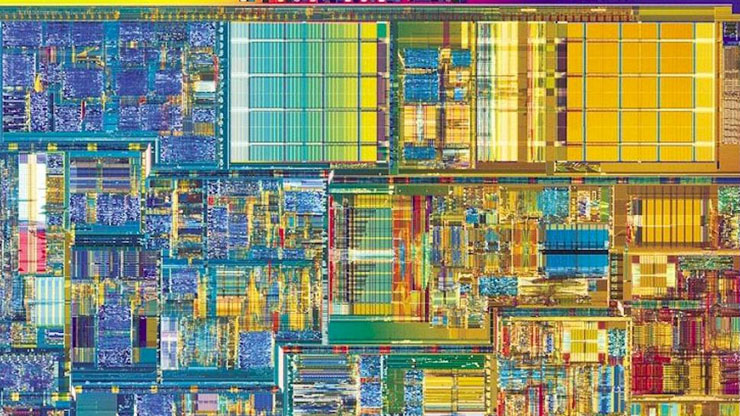

This is one of the largest producers of mobile application processors and baseband modems in the world. Qualcomm also has a large number of wireless patents, meaning it gets a piece of every smartphone sold globally.

Qualcomm's Snapdragon System on Chips is the most powerful processor on the market. It combines its application processor and baseband modem with a graphics processing unit (GPU) to provide an economical package for smartphone manufacturers. In 2020, Qualcomm's revenue increased by 12%, to $21.7 billion. The first six months of fiscal 2021 saw revenue increase 57%, year-over-year, to $16.2 billion.

ANALOG DEVICES INC (NASDAQ: ADI)

Analog is a semiconductor specialist, producing for communications, automotive, and industrial clients. This is another company that is bouncing back after its performance in 2020 that was negatively impacted by COVID-19. It was especially hard-hit in the automotive and industrial areas.

Analog's fiscal first quarter ended on January 30, 2021. Revenue increased to $1.56 billion, a 20% increase year-over-year with adjusted earnings up 40%. The company is projecting revenue of $1.60 billion in its fiscal second quarter.