Genomics and biotechnology are on the leading edge of research in medicine. It was this science that led the attack on COVID-19, determining the variants of the disease and from where they came. To be clear, genomics is the study of genes and their functions; genetics is the study of a single gene. Each of these leading companies is involved in genomics:

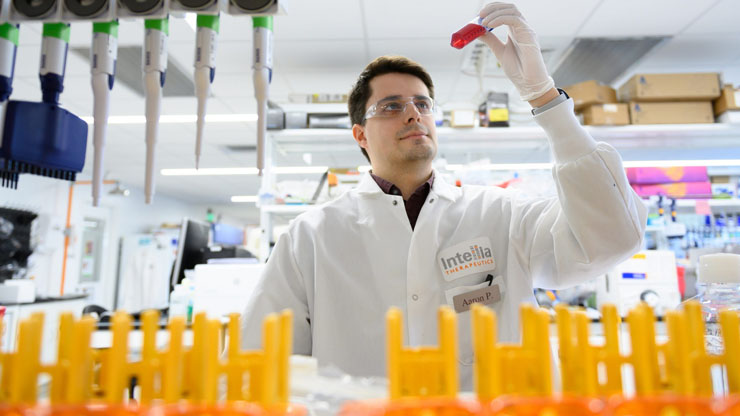

INTELLIA THERAPEUTICS INC (NASDAQ: NTLA)

Intellia is developing biopharmaceuticals using the CRISPR/Cas9 gene-editing system. It is testing several experimental treatments, including a modular lipid nanoparticle system. This system is designed to carry treatment to DNA and can be used for the delivery of multiple treatments. Additionally, Intellia has partnered with Regeneron to work on treatments for hemophilia A and B. The company is also working on genetic treatments for angioedema, leukemia, and tumors.

In July 2021, Intellia closed on an underwritten public offering of over 4.7 million shares sold at $145.00/share. The company raised $690 million with this offering.

CRISPR (NASDAQ: CRSP)

Crispr is a gene-editing company based in Switzerland. Its primary work is on life-changing, gene-based medicines to change genetic mutations and combat serious diseases. Crispr has developed proprietary technology for use in this project named Cas9. This process precisely edits genes by using an enzyme that acts like molecular scissors to cut the DNA and allowing natural DNA repair processes to take over.

In the quarter ending March 31, 2021, Crispr had revenue of $1 million. The company, which went public in October 2016, has never shown a profit. However, it has little debt and shows $1.4 billion in cash on its balance sheet.

INVITAE CORP (NASDAQ: NVTA)

Invitae is a genetic information company that provides information for genetic diagnostics, carrier screening for inherited disorders, miscarriage analysis, and hereditary cancers. Invitae's purchase of ArcherDX, in October 2020, puts the company among global leaders in comprehensive cancer genetics and precision oncology. ArcherDX has created tests that determine the best drugs with which to treat tumors.

Invitae's gross revenue for 1Q21 reached $103.6 million, a 61% increase year-over-year. Gross profit was $28.1 million, which was $4.3 million higher than that of 1Q20.