Whether people are saving, spending, or borrowing because they don't have enough, personal finance trends impact almost every other industry. Businesses and investors must stay in-the-know on these trends so they can make information-based decisions when buying or selling stock or launching a new line of service or product.

Here are five personal finance trends to keep an eye on in 2022.

1. Savings Are Important to More People

Lockdowns and layoffs related to the COVID-19 pandemic left plenty of people high and dry in 2020 and 2021. Consumers who are wary about ending up in such a position in the future may put more of a priority on savings. That could create future wealth to be invested as well as a growing market for personal finance and savings products, including high-yield savings accounts and apps to automate savings.

2. Buy Now, Pay Later Options Are Increasing

Buy now, pay later is far from a novel concept, but this growing trend isn't all about high-interest credit cards or options for personal loans. Growing numbers of retailers are partnering with lenders or other financial institutions to offer low-interest or no-interest credit options. Shoppers able to pay off purchases in a few months can get the goods now for no money down and no interest fees.

The options are designed to promote better sales numbers, but investors and others may want to keep a close eye on this one. There's the chance for a bubble to grow and, ultimately, pop if too many people buy now and don't pay later.

3. Fractional Investments Open the Markets to Newcomers

The cover charge to get into the investing game is no longer thousands of dollars. Fractional investments, which let people buy fractions of stocks for pennies lets people invest with only a few dollars. The rise of GameStop stock and Dogecoin in the past few years demonstrates the power of the people when it comes to this type of investing, and disruption will continue in the future. Investing is evolving, and traditionalists do need to take note.

4. Blockchain Supports New Investment Options

It's not just the people who are changing, either. Technology is bringing new investments like cryptocurrency and NFTs to the mainstream table. In 2022 and beyond, there's always going to be the next big thing because blockchain makes almost anything possible.

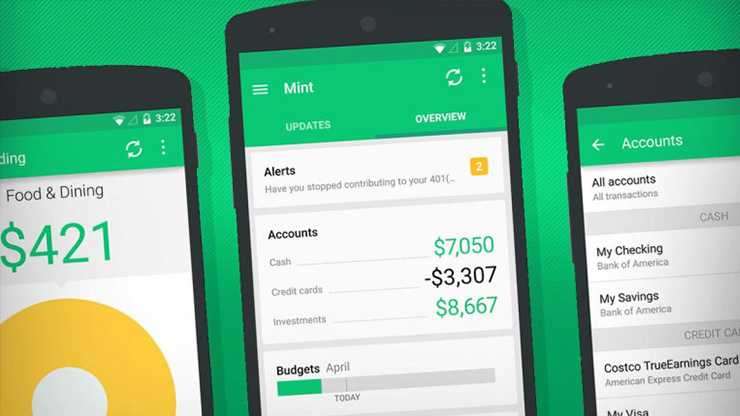

5. Personal Finance Apps Add Automation

Finally, people are becoming more financially savvy thanks, in part, to apps that help them manage money, pay their bills, invest, and even cancel subscriptions they didn't know they were paying for. Through 2022, technology will continue to put more power into the hands of everyday consumers, creating ripple effects that will eventually evolve the markets.