AI, robotics, and other advanced technologies have been infiltrating the banking industry for years. The events of 2020, however, put these advancements into overdrive. These factors along with the shift in consumer demands are transforming the financial industry and prompting the emergence of several new fintech and banking trends for 2022, such as:

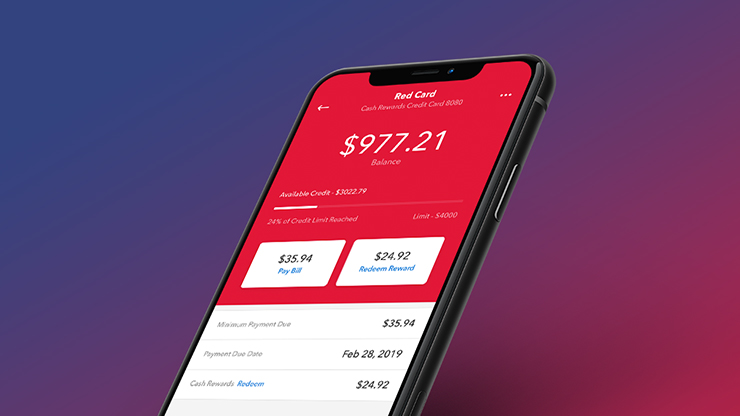

Digital Banks

With expectations that half the world’s population will participate in online banking by 2026, it’s not surprising to see more and more digital banks popping up. It’s also not surprising to see large financial institutions take steps to offer virtual banking options, such as PNC’s Virtual Wallet services. To meet the emerging demands of Millennials and Gen Zers, it’s likely that there will be a significant spike in digital banking services over the next few years.

Big Data

As is the case with most industries, the use of data aggregation and analysis is expected to increase well into 2022 and beyond. Financial institutions not only use this information to adjust their service offerings to better serve their customers but to also provide a more personalized customer experience. The right big data can help banks provide customers with a more comprehensive view of their overall financial status and ensure they are utilizing the right services at the right time.

Elimination of Overdraft Fees

It may seem unlikely that banks would eliminate a fee that rakes in millions of dollars a year, but ongoing pressure from lawmakers and consumer rights groups may force their hand. Capital One and Ally have already announced plans to eliminate this fee in 2022. While not removing these fees altogether, other major banks, such as PNC, Bank of America, and JP Morgan Chase, are either reducing these costs or giving their customers more control over their banking transactions to help avoid overdrafts.

Crypto Banking

With the popularity of cryptocurrency, it’s only a matter of time before banks jump on board. Unfortunately, only 10% of banking institutions have plans to offer any type of crypto investment services in 2022, and another 13% have plans for 2023. However, it would be surprising if more didn’t join the trend by year’s end.

Financial Wellness

The fact that 9-out-of-10 employers feel a level of responsibility for their employees’ financial wellbeing is likely behind the increase in the number of supportive services banks offer. For example, Bank of America’s Life Plan is designed to help customers take control of their finances. The demand for financial wellness services is only going to increase in 2023 as more employers seek out banks that have these offerings.

It will be interesting to see how technology and consumer demands will continue to influence financial trends in the upcoming years.