The S&P 500 capped off a remarkable year with back-to-back record highs in early December 2024, as strong corporate earnings, easing inflation concerns, and expectations of Federal Reserve rate cuts fueled one of the most resilient bull markets in recent history. The benchmark index closed at 6,090.27 on December 6, marking its 57th record closing high of the year, while the Nasdaq Composite simultaneously notched its 36th all-time high of 2024. This extraordinary performance followed a brief October downturn that ended a five-month rally, demonstrating the market's ability to rebound quickly amid shifting economic signals.

How the Record Rally Unfolded: Inside the December Surge

The final month of 2024 witnessed two distinct record-breaking sessions that captured the market's momentum. On December 4, the S&P 500 gained 0.61% to close at 6,086.49, while the tech-heavy Nasdaq advanced 1.3% to 19,735.12. The Dow Jones Industrial Average made history of its own, crossing the 45,000 threshold for the first time with a 0.69% gain to 45,014.04. Just two days later, on December 6, the indices climbed even higher, with the S&P 500 adding 0.25% to reach 6,090.27 and the Nasdaq jumping 0.81% to 19,859.77.

Tech shares led the charge, powered by exceptional earnings reports. Salesforce climbed nearly 11% after beating fiscal third-quarter revenue estimates, while chipmaker Marvell Technology surged 23% on strong fourth-quarter guidance. The Technology Select Sector SPDR Fund (XLK) reached its first all-time high since July, gaining 1.8% on December 4. Consumer discretionary stocks also shone, with Lululemon Athletica jumping 15.9% after raising full-year forecasts and Ulta Beauty advancing 9% following an upgraded profit outlook.

Timeline: How the S&P 500 Navigated Volatility to Reach New Heights

The path to December's records wasn't without turbulence. The index experienced a notable October downturn that ended a five-month rally, as investors grappled with mixed economic data and geopolitical uncertainties. November brought a decisive shift, with the S&P 500 rallying 5.2% as softening labor market data strengthened the case for Fed rate cuts. The momentum accelerated in December when the U.S. Labor Department reported job growth of 227,000 in November, but a rise in the unemployment rate to 4.2% pointed to an easing labor market – precisely the conditions the Fed has been seeking to justify further easing.

Following the jobs data, traders priced in a 90% chance of a 25-basis-point rate cut at the Fed's December 17-18 policy meeting, up from just 72% before the report. "It does support the case for the Fed to continue to cut rates in the December meeting and into the first quarter," said Bill Northey, senior investment director at U.S. Bank Wealth Management. This dovish shift occurred despite cautionary comments from Fed Governor Michelle Bowman, who warned that inflation risks remained and called for careful deliberation on future rate decisions.

Why 2024's Performance Reveals Both Strength and Vulnerability

While the S&P 500's 23% gain in 2024 represents extraordinary headline performance, a deeper analysis reveals a more complex picture. According to Charles Schwab research, the index's success was largely driven by mega-cap stocks, with the Magnificent 7 group (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) surging nearly 67% collectively. This concentration created a significant performance gap: the S&P 500 Equal Weight index gained just 10-11%, while the Russell 2000 small-cap index delivered similar returns.

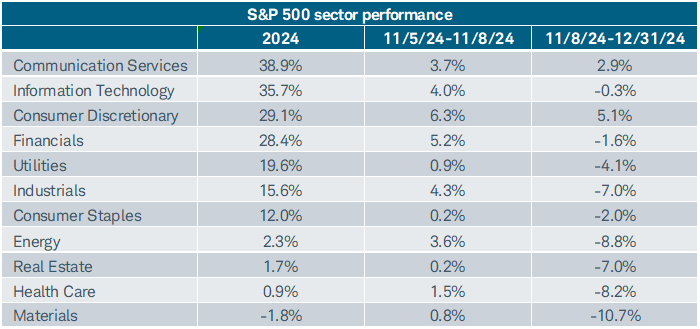

Perhaps most strikingly, only 19% of individual S&P 500 stocks outperformed the index itself in 2024. This narrow leadership raises questions about market breadth and sustainability. "An old adage on Wall Street about market breadth is that the market is strongest when the soldiers, and not just the generals, are at the front line," noted Schwab analysts. The dominance was particularly evident at the sector level, where Communication Services, Information Technology, and Consumer Discretionary – the sectors housing most mega-cap stocks – were the top performers.

Despite these concentration concerns, 2024 marked the second consecutive year with S&P 500 gains exceeding 20%, a feat not seen since the late 1990s. It was also the fourth straight year that the S&P 500 outperformed the Russell 2000, with two of those years showing spreads of more than 10 percentage points.

Where Things Stand Now: Latest on S&P 500 Composition and Sentiment

As the market enters 2025, significant changes are underway in the S&P 500's composition. Apollo Global Management and Workday will join the index prior to the open of trading on December 23, replacing Qorvo and Amentum Holdings. This quarterly rebalancing reflects the dynamic nature of the U.S. economy and the index's role as a barometer of corporate leadership. Apollo's inclusion is particularly noteworthy as it joins alternative asset manager Blackstone on the world's most-watched equity gauge, signaling growing recognition of the alternative investment sector's importance.

Market sentiment remains elevated but shows signs of frothiness. Ned Davis Research's Crowd Sentiment Poll ended 2024 with a 76-day streak in "extreme optimism" territory, a pattern that has historically correlated with increased volatility risk. "We continue to think the risk of a larger pullback would grow if breadth deteriorated further," cautioned Schwab analysts, noting that only 56% of S&P 500 members were above their 200-day moving average as of early January 2025.

What Happens Next: The Road Ahead for Investors

Looking forward, several factors will shape the S&P 500's trajectory in 2025. The Federal Reserve's rate path remains paramount, with markets expecting additional easing if economic data continues to moderate. Corporate earnings growth faces tougher comparisons after two years of double-digit gains, potentially testing valuations that have expanded significantly. Technological innovation, particularly in artificial intelligence, should continue driving productivity gains, but regulatory scrutiny may intensify under the new administration.

For investors, the key lessons from 2024's performance are clear: diversification remains essential even in a strong market, and chasing concentrated winners carries significant risk. While mega-cap stocks have driven index-level returns, hundreds of individual companies outperformed even the largest tech giants. As Nancy Tengler, CEO of Laffer Tengler Investments, observed: "People have come out and said, the tech trade's over... but that doesn't mean that they can't reaccelerate. You could argue that it's good the market's broadening out. But that doesn't mean it has to be a zero-sum game."

The Bottom Line: Key Points to Remember

The S&P 500's remarkable 2024 performance demonstrates both the resilience of U.S. equities and the growing concentration risks within the market. Investors should consider these essential takeaways:

- The index delivered 23% returns despite October volatility, marking its second straight year of 20%+ gains

- Record highs in December were fueled by strong earnings, Fed rate cut expectations, and robust tech performance

- Apollo Global Management and Workday join the S&P 500 on December 23, reflecting evolving economic leadership

- Market breadth concerns persist, with only 19% of stocks outperforming the index in 2024

- Elevated sentiment and concentration risk suggest increased volatility potential in 2025

- Diversification and focus on fundamentals remain crucial despite index-level strength

As investors navigate the opportunities and challenges ahead, the S&P 500's evolution continues to mirror the broader economic transformation underway. The index's ability to adapt its composition while maintaining its role as America's premier market benchmark ensures it will remain at the center of investment decisions for years to come.