SanDisk Corporation (NASDAQ: SNDK) shocked Wall Street on January 6, 2026, with a breathtaking 28% single-day surge that catapulted the data storage company to the top of the S&P 500 gainers list. The explosive move, which sent shares soaring to $349.63, wasn't driven by company earnings or product launches but by a single visionary statement from Nvidia CEO Jensen Huang at CES 2026, where he declared artificial intelligence's insatiable appetite for memory and storage solutions. This seemingly offhand comment ignited a sector-wide rally that saw storage stocks across the board post double-digit gains, signaling a fundamental re-rating of an industry once considered a cyclical commodity business.

How Nvidia's CEO Ignited a 28% SanDisk Stock Surge

The January 6th trading session will be remembered as the day the market finally recognized that AI isn't just about processing power—it's equally about storage capacity. SanDisk shares gapped up at the open and never looked back, closing at $349.63 after trading as high as $356.80 in after-hours activity. What made this move particularly remarkable was its sheer velocity and volume: trading activity reached 23.68 million shares, a massive spike compared to normal levels, indicating institutional money flooding into the sector.

"The aggressive move is a direct reflection of a fundamental re-rating of the entire memory and storage sector," noted the Trefis analysis team. "The narrative has solidified: AI is fundamentally a storage problem, and the market is pricing in a sustained 'supercycle' of demand and pricing power." This sentiment was echoed across trading desks as Western Digital surged 17%, Seagate Technology jumped 14%, and Micron Technology advanced 10% in a coordinated sector rally.

From CES to Market Frenzy: The 24 Hours That Changed SanDisk

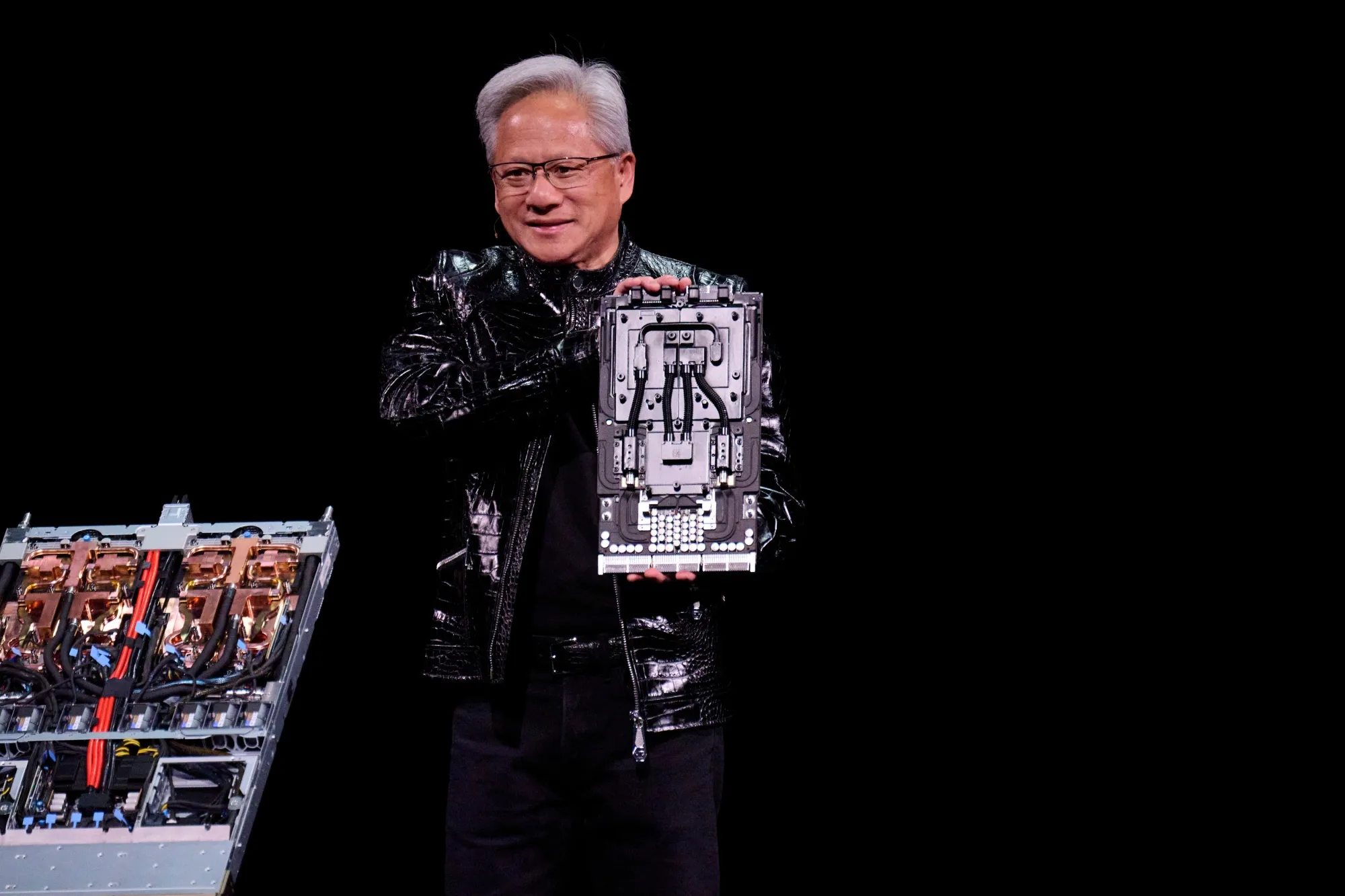

The chain reaction began on January 5th at the Consumer Electronics Show in Las Vegas, where Nvidia's CEO Jensen Huang took the stage to outline his vision for AI's future. In what market participants later described as a "bombshell" statement, Huang emphasized that "storage and memory components are becoming as critical as processing power for advanced artificial intelligence systems." He went further, suggesting that the AI sector could evolve into "the world's largest storage market."

These comments resonated through trading circles overnight, and by Tuesday morning, the implications were clear: every AI model training run, every inference query, and every data-intensive application would require exponentially more high-performance storage. Bloomberg reported that "Sandisk Corp. shares jumped 28% Tuesday, their best performance since February, after Nvidia Corp. Chief Executive Officer Jensen Huang highlighted the need for memory and storage in comments at the CES tech conference."

The timing couldn't have been better for SanDisk, which had recently completed its spin-off from Western Digital and was aggressively positioning itself for the AI era. Within hours of Huang's remarks, analyst notes began circulating about SanDisk's technological advantages, including its BiCS8 218-layer 3D NAND technology specifically designed for high-density AI workloads.

AI's Storage Problem: Why Memory Stocks Are the New AI Play

What makes this rally fundamentally different from previous storage sector cycles is the structural nature of AI demand. Unlike the cyclical patterns driven by smartphone releases or PC refresh cycles, AI infrastructure represents a sustained, multi-year buildout with virtually unlimited appetite for storage solutions. Whalesbook analysis highlighted that "tight supply conditions and rising prices, combined with expanding demand for AI training and inferencing, are supporting gains in digital storage stocks."

The numbers tell a compelling story: NAND flash contract prices are projected to surge 33-38% in the first quarter of 2026, with enterprise SSDs expected to jump over 40%. This pricing power comes at a perfect time for SanDisk, which has gained approximately 2 percentage points of NAND market share over the past year while competitors like Samsung, SK Hynix, and Kioxia have seen their positions erode.

SanDisk's strategic moves have also positioned the company well for this moment. The company recently rebranded its product lineup, transforming its "Blue" SSDs into SanDisk Optimus and "Black" SSDs into Optimus GX, with a new high-performance Optimus GX PRO targeting developers, professionals, and gamers building AI PCs and workstations. This branding clarity, combined with technological leadership, has helped investors understand SanDisk's positioning in the AI value chain.

Where SanDisk Stands After the Historic Rally

As of January 7, 2026, SanDisk shares have given back some of their explosive gains but remain significantly elevated, trading around $340—still up approximately 47% in just the first three trading sessions of 2026. More remarkably, the stock has soared an astonishing 1,080% since hitting its low on April 22, 2025, shortly after completing its spin-off from Western Digital.

The company's inclusion in the S&P 500 index in late November 2025 provided additional institutional validation, though few could have predicted the velocity of this latest move. According to Investopedia's market coverage, "Sandisk, which joined the S&P 500 in late November, is trading around $336 after debuting at $36 less than a year ago, in February 2025." This represents nearly a tenfold increase in under twelve months.

Market technicians are closely watching the $300 level, which served as prior resistance and now represents a crucial support zone. As Trefis analysts noted, "A successful re-test and hold of this level would confirm that institutional buyers are defending the new valuation floor, setting the stage for the next leg up towards $400."

Can SanDisk Stock Reach $400? Experts Weigh In

The burning question for investors is whether this rally represents a sustainable re-rating or a speculative bubble. Industry experts point to several factors supporting continued strength. First, the AI storage demand story appears durable, with hyperscalers like Amazon, Microsoft, and Google building out massive AI infrastructure that requires petabytes of high-speed storage. Second, supply constraints in the NAND market are expected to persist through 2026, supporting pricing power. Third, SanDisk's technology leadership in high-density 3D NAND positions it to capture disproportionate benefits from this trend.

However, risks remain. The storage sector has historically been cyclical, and current valuations assume a permanent shift in market dynamics. Any slowdown in AI investment or unexpected supply increases could pressure margins. Additionally, with the stock up over 1,000% in less than a year, profit-taking is inevitable.

Bloomberg Intelligence analyst Jake Silverman summarized the situation: "Tight supply conditions and rising prices, combined with expanding demand for AI training and inferencing, are supporting gains in digital storage stocks. Huang's comments suggest enduring demand for NAND storage within Nvidia's ecosystem." This institutional validation suggests the rally has fundamental underpinnings beyond mere speculation.

Key Takeaways for Investors

The SanDisk story offers several important lessons for investors navigating the AI revolution:

- AI's infrastructure demands extend beyond GPUs: The storage sector represents a critical—and previously undervalued—component of the AI value chain.

- Structural shifts create new leaders: SanDisk's market share gains during this transition demonstrate how technological leadership can translate into competitive advantage during industry inflection points.

- Volume and velocity matter: The massive trading volume (23.68 million shares) accompanying the 28% surge indicates institutional conviction, not just retail speculation.

- Sector correlations remain strong: The coordinated rally across SanDisk, Western Digital, Seagate, and Micron suggests this is a sector-wide re-rating rather than a single-stock story.

- Watch the $300 support level: Technical analysts view this as a crucial test of whether the new valuation floor will hold.

As the AI revolution continues to unfold, storage companies like SanDisk are moving from supporting players to center stage. The dramatic January 6th rally may represent just the beginning of a fundamental reappraisal of how investors value the infrastructure underpinning artificial intelligence. For those who understand that data needs somewhere to live, the storage sector offers compelling opportunities—but only for investors prepared for the volatility that comes with such transformative shifts.