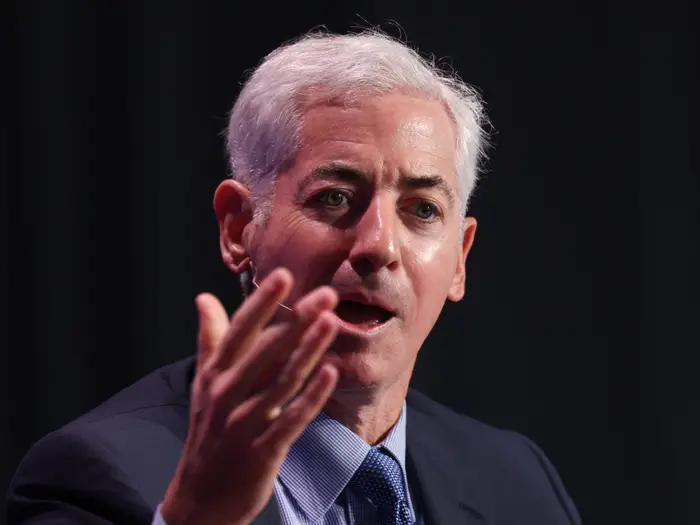

President Donald Trump has ignited a fierce debate across Wall Street and Main Street with his sudden call for a one-year, 10% cap on credit card interest rates, a move that could save Americans an estimated $100 billion annually but has drawn immediate condemnation from both billionaire investor Bill Ackman and the entire banking industry. In a Truth Social post on Friday evening, Trump declared that "we will no longer let the American Public be 'ripped off' by Credit Card Companies" and announced the cap would take effect January 20, 2026—the first anniversary of his second inauguration. The announcement, which Trump originally pledged during his 2024 campaign, comes as American households grapple with record credit card debt exceeding $1.2 trillion and average interest rates hovering near 22%. While the proposal has been hailed by some bipartisan lawmakers as long-overdue consumer relief, financial experts warn the unprecedented government intervention could trigger massive credit card cancellations and push vulnerable borrowers toward predatory lenders.

How Trump's Credit Card Cap Announcement Unfolded

The president's social media declaration late Friday marked the culmination of a week filled with populist economic proposals aimed at addressing voter frustration over affordability. "Effective January 20, 2026, I, as President of the United States, am calling for a one year cap on Credit Card Interest Rates of 10%," Trump wrote, echoing language from his campaign trail. The move represents a stark reversal from his administration's previous stance—just last year, Trump's Justice Department joined banking groups in successfully challenging a Biden-era rule that capped credit card late fees at $8.

Notably absent from Trump's announcement was any explanation of how the cap would be enforced or whether it would require congressional approval. White House officials declined to provide additional details when pressed by multiple news organizations, leaving analysts to speculate whether the administration plans executive action or will seek legislation. The ambiguity has created uncertainty in financial markets, with credit card company stocks showing mixed reactions in early trading.

The banking industry responded within hours through a rare unified statement from five major trade groups representing virtually all U.S. lenders. "We share the President's goal of helping Americans access more affordable credit," read the joint statement from the American Bankers Association, Bank Policy Institute, Consumer Bankers Association, Financial Services Forum, and Independent Community Bankers of America. "At the same time, evidence shows that a 10% interest rate cap would reduce credit availability and be devastating for millions of American families and small business owners who rely on and value their credit cards."

Timeline: From Campaign Promise to Presidential Decree

The road to Trump's Friday announcement traces back to September 2024, when he first floated the idea of capping credit card interest rates during a campaign rally. At the time, political analysts dismissed it as election-year rhetoric, noting that such a move would require congressional approval. Following his election victory, the promise languished for over a year while credit card debt continued its relentless climb.

In February 2025, Senators Bernie Sanders (I-VT) and Josh Hawley (R-MO) seized on Trump's unfulfilled pledge by introducing bipartisan legislation that would cap rates at 10% for five years. "When large financial institutions charge over 25 percent interest on credit cards, they are not engaged in the business of making credit available. They are engaged in extortion and loan sharking," the senators declared. The bill gained little traction amid fierce banking lobby opposition.

The timeline accelerated dramatically this week. On Thursday, Sanders publicly criticized Trump for failing to deliver on his campaign promise. Just hours later, the president made his announcement, followed within minutes by billionaire investor Bill Ackman's now-deleted tweet calling the move "a mistake." By Saturday morning, Ackman had softened his tone but maintained his warning about potential credit card cancellations, while Senator Hawley tweeted his enthusiastic support: "Fantastic idea. Can't wait to vote for this."

Why Trump's Credit Card Cap Matters: Economic Impact and Investor Backlash

The proposed 10% cap represents one of the most aggressive interventions in consumer credit markets in modern American history. Currently, the average credit card interest rate stands between 19.65% and 21.5%, according to Federal Reserve data—more than double what it was a decade ago. With 195 million Americans carrying credit cards and paying approximately $160 billion in annual interest charges, even a modest reduction could have profound economic implications.

Research from the Vanderbilt Policy Accelerator suggests that capping rates at 10% would save consumers roughly $100 billion per year while still leaving the credit card industry profitable, though potentially requiring scaling back of rewards programs. "A 10% credit card interest cap would save Americans $100 billion a year without causing massive account closures, as banks claim," said Brian Shearer, director of competition and regulatory policy at the accelerator. "That's because the few large banks that dominate the credit card market are making absolutely massive profits on customers at all income levels."

However, the investor backlash led by Pershing Square Capital Management CEO Bill Ackman highlights the deep divisions within Trump's own coalition. "Without being able to charge rates adequate enough to cover losses and to earn an adequate return on equity, credit card lenders will cancel cards for millions of consumers who will have to turn to loan sharks for credit at rates higher than and on terms inferior to what they previously paid," Ackman warned in his initial response. While acknowledging that reducing credit card rates is a "worthy and important" goal, the billionaire investor argued that market-based competition—not price controls—represents the better solution.

Banking analysts point to historical precedents that suggest rate caps can have unintended consequences. When Congress capped debit card interchange fees in 2010, banks responded by eliminating debit card rewards programs, which only recently began returning to the market. Similarly, Arkansas's strictly enforced 17% interest rate cap has been shown to limit credit access for low-income borrowers, pushing them toward less regulated alternatives.

The proposal also exposes a fundamental tension within Trump's economic agenda: while positioning himself as a populist fighting for working-class Americans, his administration has consistently taken pro-business stances on financial regulation. This contradiction was highlighted by Senator Elizabeth Warren (D-MA), who noted, "Trump promised to cap credit card interest rates at 10% and stop Wall Street from getting away with murder. Instead, he deregulated big banks charging up to 30% interest on credit cards."

Where Things Stand Now: The Battle Lines Are Drawn

As of Saturday morning, the White House has not provided additional details about how it plans to implement the proposed cap, leaving both supporters and opponents scrambling to determine next steps. Congressional staffers indicate that if the administration seeks legislation, they would likely build upon the existing Sanders-Hawley bill in the Senate and the Ocasio-Cortez-Luna bill in the House, both of which propose similar 10% caps.

The banking industry has mobilized its substantial lobbying apparatus to oppose any cap, with trade groups preparing economic impact studies and threatening legal challenges if the administration attempts executive action without congressional approval. Meanwhile, consumer advocacy organizations have launched campaigns urging lawmakers to support the measure, framing it as essential relief for families struggling with record debt.

Financial markets are taking a wait-and-see approach, with shares of major credit card issuers like American Express, Capital One, JPMorgan Chase, and Bank of America showing limited movement amid the uncertainty. Analysts suggest that if the cap appears likely to become reality, credit card companies would likely respond by tightening lending standards, reducing credit limits, and scaling back rewards programs—changes that could disproportionately affect lower-income borrowers.

What Happens Next: The Road Ahead for Credit Card Reform

The coming weeks will determine whether Trump's proposal evolves from social media declaration to concrete policy. Key developments to watch include whether the White House submits formal legislation to Congress, how Republican leadership responds to a measure that divides their traditional business and populist wings, and whether Democrats can overcome their skepticism of Trump's motives to support consumer relief.

Most observers believe any lasting solution will require congressional action, setting up a potential showdown between the banking lobby's influence and growing public frustration over household debt. Even if legislation passes, legal challenges are inevitable, potentially delaying implementation for years. In the meantime, credit card companies may begin adjusting their practices in anticipation of possible changes, creating immediate consequences for consumers regardless of the proposal's ultimate fate.

Key Takeaways from Trump's Credit Card Cap Announcement

- President Trump has called for a one-year, 10% cap on credit card interest rates starting January 20, 2026

- The move could save Americans an estimated $100 billion annually but faces fierce opposition from banks and investors like Bill Ackman

- Bipartisan legislation already exists in both chambers of Congress but has stalled amid banking industry resistance

- Implementation details remain unclear, with questions about whether executive action or legislation will be pursued

- Consumers could see immediate changes in credit availability and card terms as lenders prepare for potential regulation