When evaluating investment income, it's important to understand the types of dividends received. Many investors ask, 'What Are Qualified Dividends?' These dividends can offer significant tax advantages if they meet specific IRS requirements. Knowing how to identify and benefit from qualified dividends can help you make more informed investment choices and reduce your tax burden.

Understanding The Basics: What Are Qualified Dividends?

Qualified dividends are a type of dividend that meets certain criteria established by the IRS, which allows them to be taxed at the lower long-term capital gains tax rates rather than ordinary income tax rates. To fully answer the question 'What Are Qualified Dividends?', it's essential to understand that not all dividends qualify. Companies must be based in the U.S. or in a qualifying foreign country, and investors must meet specific holding period requirements, among other conditions.

Difference Between Qualified And Ordinary Dividends

Ordinary dividends are taxed like regular income, meaning they can be subject to higher tax rates depending on your income bracket. In contrast, qualified dividends enjoy lower tax rates, typically capped at 0%, 15%, or 20%. So when investors ask 'What Are Qualified Dividends?', they often want to understand how these differ from ordinary dividends and why the distinction matters for their overall tax strategy.

IRS Criteria For Qualified Dividends

The IRS has laid out clear rules for determining 'What Are Qualified Dividends?' To qualify, the dividend must be paid by a U.S. corporation or a qualified foreign corporation. Additionally, the investor must hold the stock for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date. These criteria ensure that only long-term investments benefit from the reduced tax rate.

How Qualified Dividends Are Taxed

One of the main reasons investors care about the question 'What Are Qualified Dividends?' is due to the tax implications. These dividends are taxed at the long-term capital gains rate, which is significantly lower than ordinary income tax rates. Depending on your taxable income, your qualified dividend tax rate could be as low as 0%, offering a substantial tax break compared to standard income.

Benefits Of Qualified Dividends For Investors

Investors who understand 'What Are Qualified Dividends?' can optimize their portfolios for tax efficiency. By holding onto stocks that regularly pay qualified dividends and meeting the required holding period, investors can reduce their annual tax liabilities and increase their after-tax returns. This makes dividend investing more appealing, especially for long-term financial planning.

Examples Of Qualified VS. Non-Qualified Dividends

To contextualize 'What Are Qualified Dividends?', consider examples: Dividends from stocks like Apple or Microsoft usually qualify if the holding period rules are met. On the other hand, dividends from REITs (Real Estate Investment Trusts) and certain foreign companies typically do not qualify under IRS rules. Recognizing these differences helps investors manage expectations and strategize dividend income.

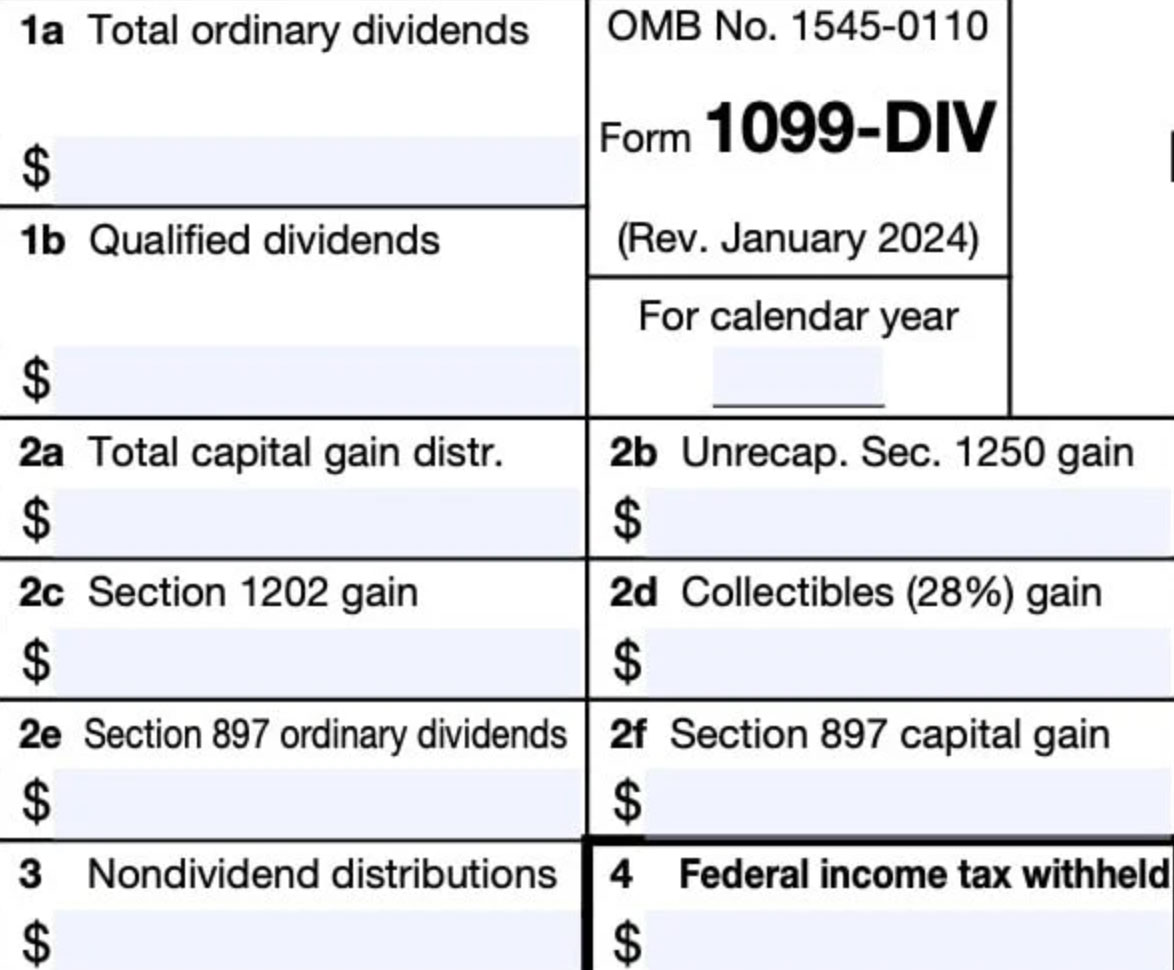

Role Of 1099-DIV Form In Identifying Dividends

Investors often wonder how to tell 'What Are Qualified Dividends?' when reviewing their tax documents. The 1099-DIV form issued by brokerage firms includes this information. Box 1a shows total ordinary dividends, and Box 1b indicates the portion that qualifies for favorable tax treatment. Reviewing this form carefully each tax season is essential for accurate reporting.

Investment Strategies Focused On Qualified Dividends

When investors ask 'What Are Qualified Dividends?' they're often seeking advice on strategy. A practical approach is to focus on high-quality, dividend-paying U.S. companies and to hold these stocks long enough to meet the IRS holding requirements. Additionally, utilizing tax-advantaged accounts like Roth IRAs can further enhance the benefits of earning qualified dividends.

Common Mistakes To Avoid With Qualified Dividends

A frequent mistake when evaluating 'What Are Qualified Dividends?' is not meeting the holding period requirement, which causes dividends to be taxed as ordinary income. Another common error is failing to consult the 1099-DIV properly, which can lead to misreporting on tax returns. Awareness of these pitfalls ensures you get the maximum benefit from your dividend income.

Understanding 'What Are Qualified Dividends?' is crucial for investors looking to minimize tax liability and enhance returns. These dividends not only provide a stream of income but also offer favorable tax treatment if all qualifying criteria are met. By applying the knowledge of how qualified dividends work—from identifying them on tax forms to adopting sound investment strategies—you can make smarter, more tax-efficient financial decisions.