The world of investing is evolving rapidly, and one of the most innovative tools to emerge in recent years is copy trading. But what is copy trading exactly, and how can it benefit both new and experienced traders? This article explores the ins and outs of copy trading, its pros and cons, and how you can get started with it.

Understanding What Is Copy Trading

Copy trading is a form of automated trading where individuals can copy the trades of professional or experienced traders. Essentially, it allows investors to replicate the strategies and performance of others in real-time. This system is beneficial for beginners who may not yet have the expertise needed to make informed trading decisions.

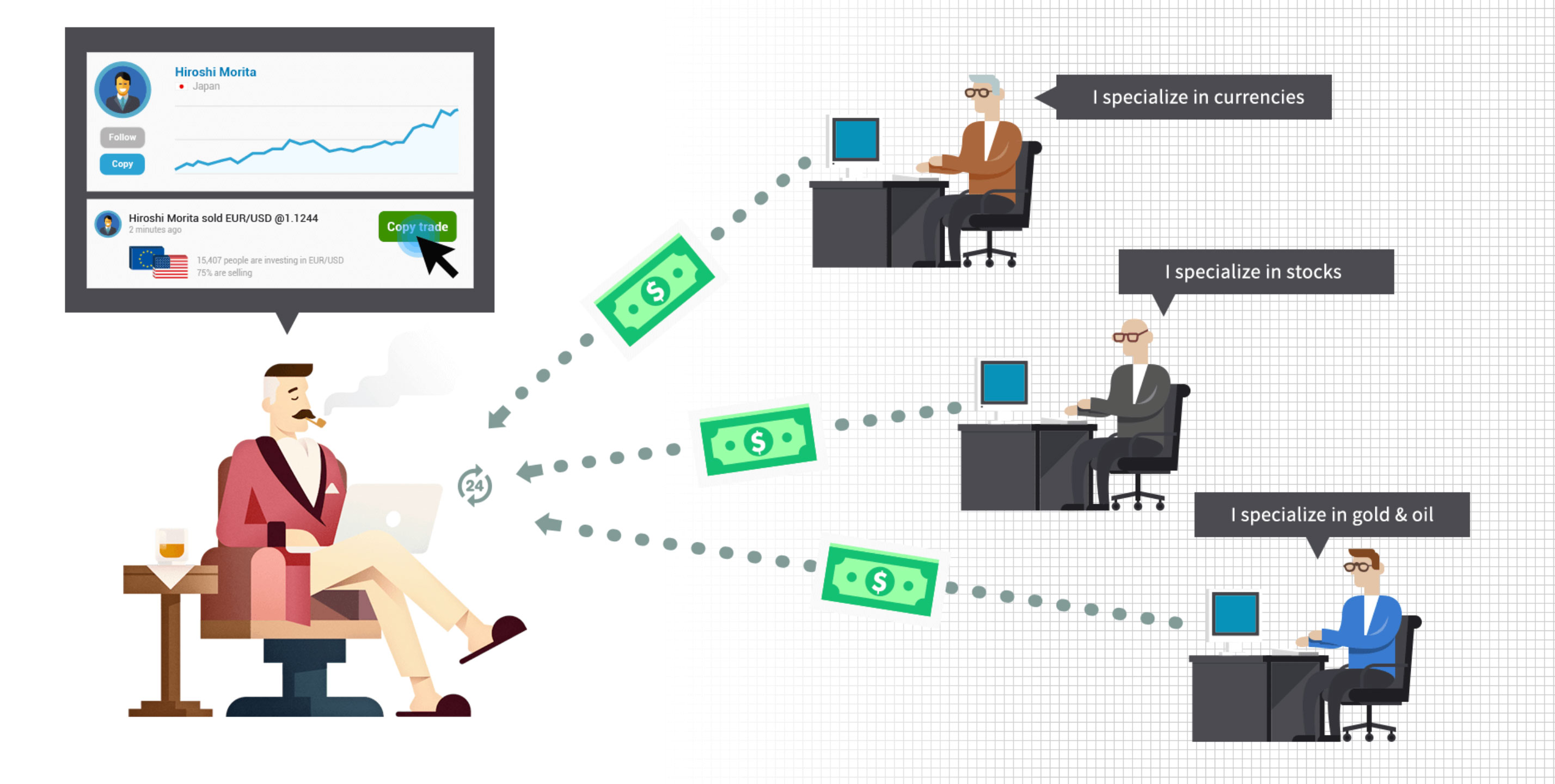

How Does Copy Trading Work?

So, what is copy trading in practice? Once you choose a trader to follow on a copy trading platform, all their trade positions are mirrored in your account. Investments are made in proportion to your capital. This seamless process enables hands-off management while giving you exposure to dynamic market opportunities.

Benefits Of Copy Trading

The primary advantage of copy trading is that it grants access to seasoned trading strategies without requiring prior knowledge. It helps save time, lowers emotional trading decisions, and enables portfolio diversification. This makes copy trading especially attractive to beginners who want to learn while earning.

Risks Involved In Copy Trading

While copy trading offers several benefits, it is not without risks. Market volatility, poor performance by copied traders, and reliance on third-party platforms can lead to financial losses. It's important to research and choose experienced traders with consistent performance before mirroring their trades.

Choosing The Right Copy Trading Platform

When exploring what is copy trading, it's crucial to select the right platform. Look for platforms that are transparent, user-friendly, and regulated. Some popular copy trading platforms include eToro, ZuluTrade, and CopyMe. These platforms provide performance metrics to help you choose suitable traders to follow.

Who Should Consider Copy Trading?

Copy trading is ideal for novice investors, busy professionals, and those looking to passively grow their wealth. It offers a learning opportunity for newcomers and allows seasoned traders to earn commissions by letting others copy their trades, creating a win-win ecosystem for users.

Copy Trading vs. Social Trading

Understanding what is copy trading also involves distinguishing it from social trading. While both let users observe or follow traders, social trading emphasizes interaction and community insights, encouraging collaborative decision-making. Copy trading, on the other hand, focuses more on replicating actual trades automatically.

Key Factors To Consider Before Copy Trading

Before diving into copy trading, consider your risk tolerance, investment amount, and the credibility of the trader you wish to follow. Also, understand the platform's fee structure and withdrawal policies. Doing due diligence ensures you're making informed decisions aligned with your financial goals.

Future Of Copy Trading

The copy trading industry is expected to grow as more investors seek ways to automate and simplify their trading experience. With improvements in AI and data analytics, the effectiveness of copy trading is likely to increase. Staying informed about what is copy trading can prepare you for future investment trends.

In conclusion, understanding what is copy trading provides valuable insight into an increasingly popular investment strategy. By allowing users to replicate the trades of successful investors, copy trading creates opportunities for learning and profit. However, it also requires careful consideration and research. As the financial world continues to evolve, copy trading could be a game-changer for both new and experienced investors alike.