Semiconductors are an important key to modern technology, and anyone who has even vaguely kept up with news in the post-pandemic world knows that a lack of chips can bring whole supply chains to their knees. The pressure on the semiconductor manufacturers to churn out ever more chips can be a lot, but it has driven up the value of those businesses. That makes semiconductor stocks a great addition to many portfolios in 2022.

It's not only pandemic pressures that have driven up semiconductor stock values in recent years. The technological world literally runs on chips. They're in everything from iPhones to electric vehicles. They're important to almost every industry, including staples such as health care, computing, defense, clean energy, and communications.

Those are facts that won't change much anytime in the near future. And with a growing and stable demand for chips, investors can be bullish on established semiconductor stocks. Here are a few that may be worth keeping in mind.

Skyworks Solutions

NASDAQ:SWKS. Skyworks Solution is a major supplier of parts and chips to Apple, which means it has the client list to be stable. It's also demonstrated a robust cash flow and capitalization that it uses to invest in R&D and other products, diversifying its revenue streams.

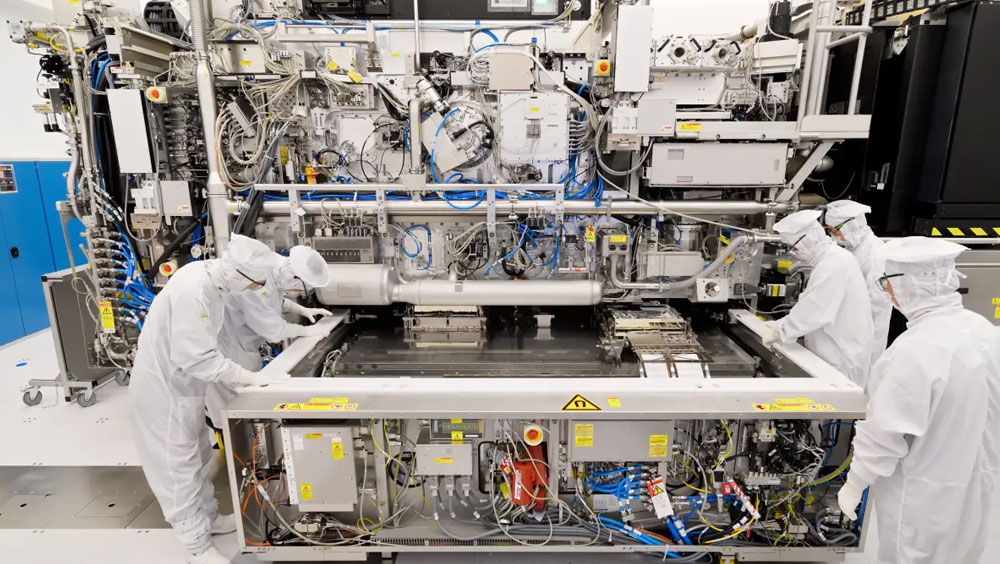

ASML Holding N.V.

NASDAQ:ASML. This semiconductor system manufacturer expects to grow rapidly, bringing in an annual revenue in the billions within the next three years. Analysts are especially bullish on this stock, and lead investors known for directing the markets have been buying ASML stock.

Nvidia

NASDAQ:NVDA. Nvidia is a well-known name in GPU and computing accessories. It's also a manufacturer of semiconductors and a darling of both leading investors and computer enthusiasts.